Energy

We help investors, senior executives and boards enhance ROI and valuation.

energy spectrum

We work across the spectrum of fossil-based and alternative sources of energy.

HOW WE ADD VALUE

We use industry knowledge coupled with policy, geopolitical, technology and environmental nuance to sharpen strategy, align organizations and drive organic and acquisition growth.

Breadth of perspective across the energy sector, its richness and complexity enrich our work.

Private equity transactor and portfolio company CEO services

We have worked with PE firms and energy sector portfolio companies in the US and Europe.

Energy related PE experience includes: board advisory, pre and post LOI buy and sell-side diligence, strategic and business planning, investor messaging, exit preparation, banker teasers, S-1's and operating executive work.

Results have included: enhanced portfolio company EBITDA, growth and multiples, and more informed decision-making across the deal sourcing, evaluation, hold and exit process.

Please see here for more details of the services we provide, energy sectors we have covered, and examples of results, including contributing to a 10x PE return on a shale, deepwater drilling, steam assisted gravity drainage, and enhanced oil recovery technology innovator.

C-suite Strategy & Execution

We have worked with energy sector senior executive in: Fortune 1000 divisions, rapid and slow growth cash-flowing companies, startups, government agencies, academic institutions and non-profits.

Experience includes: strategic plans, business plans, analyst and investor presentations, new product assessment, technology, economic, political and technical evaluation, and operating executive work.

Results have included: Positive analyst perceptions, well-received business plans, strategic clarity, and organizations positioned for domestic and international growth.

Please see below for more details of our C-suite strategy and execution services.

Examples

FOSSIL BASED SOURCES OF ENERGY

Fortune 1000 corporation's Europe-based specialty high temperature high pressure drilling and completion fluids division:

Partnered with the division’s new division President, who had no prior oil services experience, to help him review strategy and reverse negative analyst perceptions of prior leadership at upcoming Analyst Day:

Served as President’s sounding board

Determined that management generally agreed their product had no direct competitors, but held differing perspectives on its sweet spot(s) and value proposition

Expanded company’s product-based market definition by working closely with its senior technical lead to identify technologies and processes that serve the same pressure management function by jurisdiction around the world, and corresponding competitor sets

Evaluated Deepwater Horizon’s impact on pressure management regulations and revenue by jurisdiction

Helped President articulate crisp product description, value proposition, target customers and priority jurisdictions.

Challenged profit driver assumptions and pricing strategy

Opined on senior executive capabilities

Provided high-level input on corporate strategy questions regarding whether to sell, grow or use the division as a cash cow

Co-created the investor narrative that successfully reversed negative analyst perceptions 7 weeks after arrival.

Private Equity and Portfolio Companies:

We have done extensive work on fossil related transactions and portfolio companies.

Please see here for Examples, including:

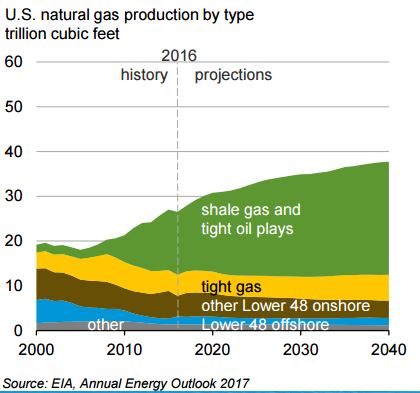

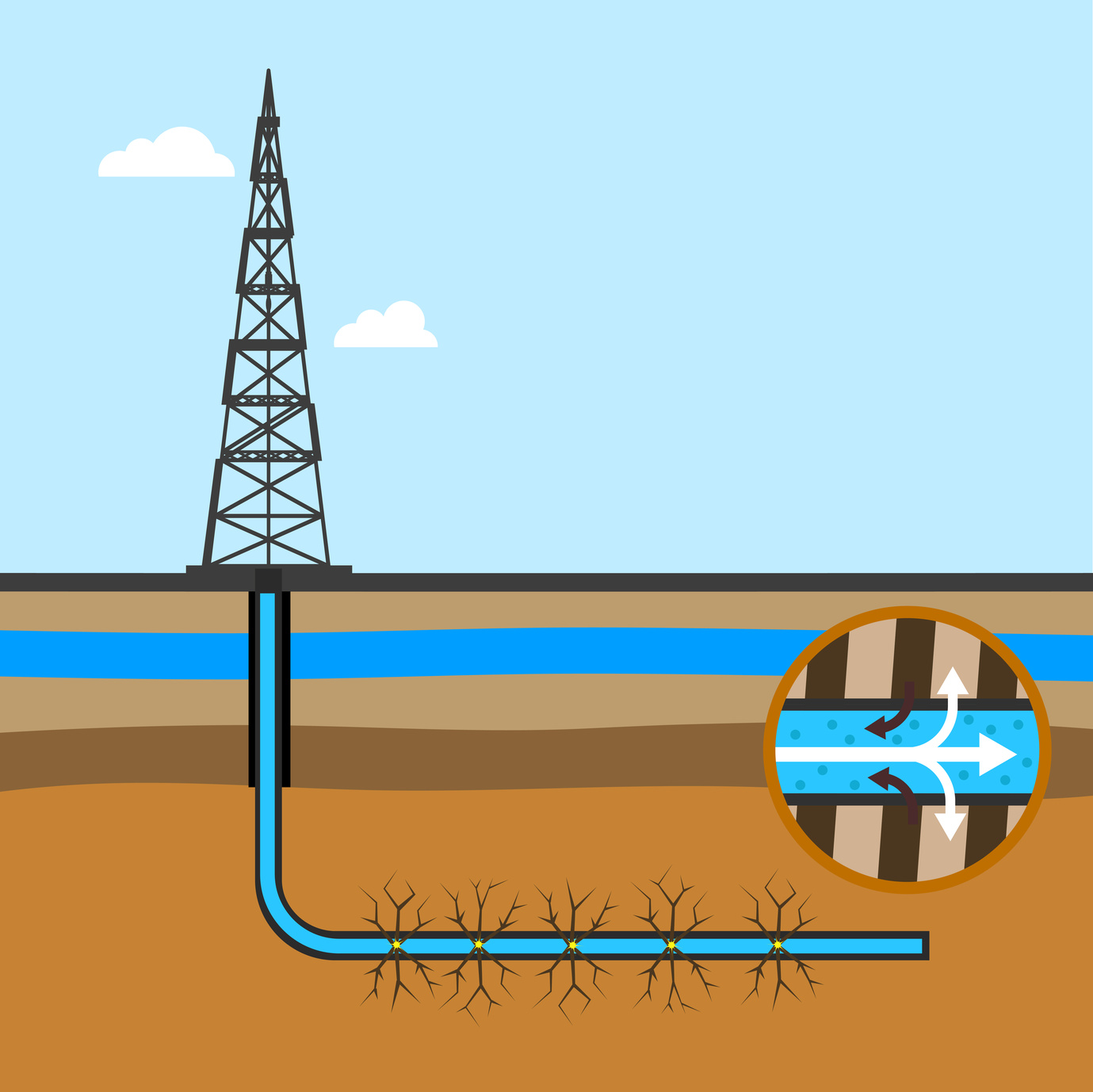

How we contributed to a 10x private equity return on a technology innovator that helped enable the shale revolution and advancements in deepwater drilling, steam assisted gravity drainage, and enhanced oil recovery

Numerous buy and sell-side diligence activities that helped enhance risk-adjusted returns.

ALTERNTIVE SOURCES OF ENERGY

A Public Sector Green Bank:

We wrote the draft business plan for a young $1 billion capitalization state-owned bank that transforms alternative energy and energy efficiency projects into assets that attract large private sector institutional investors.

At the time, the bank had just left its pre-investment start-up phase and was rapidly scaling investment activity toward its anticipated steady state rate of investment. External audiences had previously expressed general lack of clarity around the young bank’s investment scope, products, strategy and accomplishments and were unaware the Green Bank had entered its next phase of organizational development.

To develop a plan that was clear, meaningful and changed perceptions of multiple stakeholders including at the Public Service Commission, Governor’s office, other financial services institutions, potential clients, watchdogs and others, we:

Collectively went through an iterative process that led to a clear, confident and action oriented plan.

Helped the C-suite leverage the mandated business plan into a value added business planning process.

Facilitated the C-suite in developing a common understanding of goals, objectives, action items, performance indicators and metrics

Prepared documents the C-suite used to engage its funders.

Stripped out jargon, used simpler terms all around and translated sophisticated financial products, structures and innovations into language that multiple stakeholders could understand.

The plan was well-received, energized management and successfully changed stakeholder perceptions.

A Port Authority:

We evaluated a contemplated alternative aviation fuel production facility’s commercial, environmental, political and funding feasibility:

Reviewed existing and emerging alternative aviation fuel technologies and projects

Evaluated range of potential feedstocks including natural gas, algae, agricultural products, trash and plastic on technology, environmental, local availability and transportation cost

Dove deep into the feasibility of trash-based feedstock, including: local volumes, rail and truck transportation routes and total feedstock cost

Prepared a high-level stakeholder map and identified likelihood of support and key considerations by stakeholder

Highlighted political considerations

Identified potential federal government funders and funding processes.

We collaborated with the Departments of Defense and Agriculture, the commercial aviation sector and non-profits throughout the engagement.

Venture capital backed algae technology company:

Provided input into high-level global business strategy and coordinated response to DARPA solicitation for algae-based alternative aviation fuel:

Assessed existing commercially-viable algae uses and broad research direction for new algae uses.

Evaluated range and status of emerging algae technology

Reviewed competitive landscape including leading academic and private sector collaborations based out of Israel and the West Coast

Evaluated economics of various algae technologies

Represented company at DARPA solicitation information meeting, met with DARPA staff who advised joining or forming a consortium, identified potential aircraft and aircraft engine manufacturers for outreach.

Venture capital backed alternative energy data provider:

We advised the board of a rapidly growing company that had a high cash burn rate:

- Built strong rapport with the CEO, which increased receptivity to board input

- Advocated cash preservation to increase runway ahead of an economic downturn, while others favored continuing its rapid international expansion to get to scale as quickly as possible

- Interviewed CEO candidates and provided observations that proved astute in hindsight.

Thought Leadership

We are thought leaders at the intersection of energy with policy, technology and environment. See more

We leverage our relationships with financial institutions, oil and gas and alternative energy operators, think tanks, academia and not-for-profit advocacy groups to forge balanced and constructive solutions to multi-stakeholder issues.

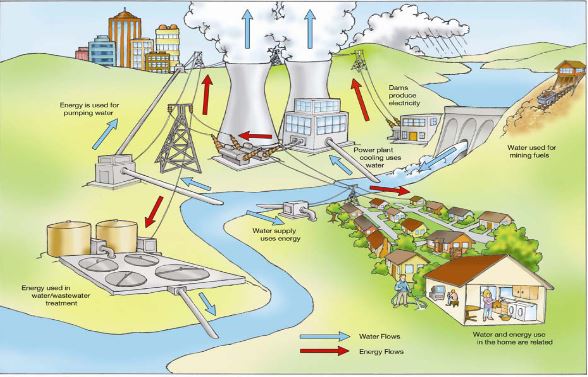

- Authored -- The Water-Energy Nexus: Adding Water to the Energy Agenda

Shell (headquarters) – We provided water-energy expertise into global strategy planning scenarios.

Academic research -- We conceived an innovative Marcellus Shale research approach, and put together an environment school's hydrology/chemical engineering professor, an upstream oil and gas operator host, a nationally recognized non-profit observer and a private sector funder.

Yale Climate and Energy Institute -- Advisory Board

Canadian Shale Thought Leaders Forum -- Advisory Board

Upstream oil and gas operator's shareholder engagement initiative – Participate in expert round table that provides input into risk management and governance considerations.